Ride the Waves: Surfing Adventures and Tips

Explore the world of surfing with expert advice, gear reviews, and the latest trends.

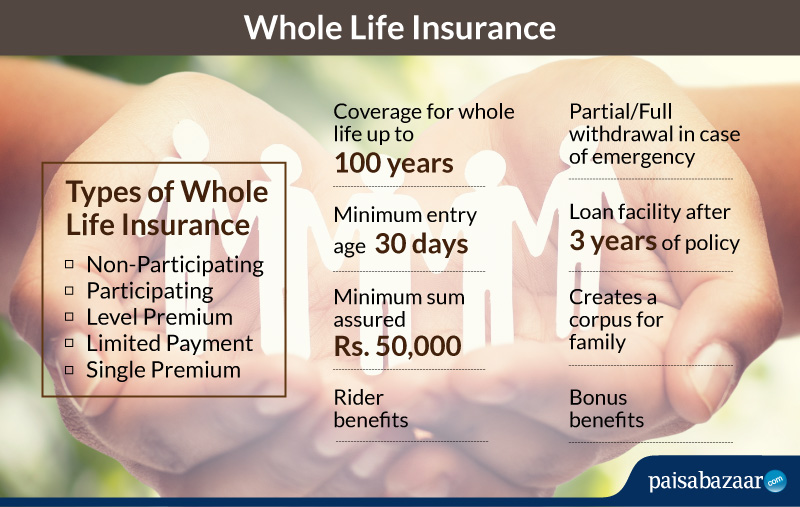

Whole Life Insurance: A Policy with a Punch

Uncover the power of whole life insurance! Discover how this policy can provide financial security and surprise benefits. Don't miss out!

What You Need to Know About Whole Life Insurance: Benefits Explained

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire life, as long as premiums are paid. One of the key benefits of whole life insurance is its cash value component, which grows over time at a guaranteed rate, offering a financial safety net alongside the death benefit. This means not only do you have a policy that protects your loved ones, but you also have a savings-like feature that can be borrowed against or withdrawn during your lifetime, making whole life insurance a versatile financial tool.

Additionally, whole life insurance offers valuable predictability with fixed premiums that do not increase as you age, allowing for better long-term financial planning. The death benefit payout is also guaranteed, providing peace of mind that your beneficiaries will receive financial support when they need it the most. If you are considering life insurance options, it's essential to weigh the benefits of whole life insurance against your financial goals, as it can serve not only as a safety measure but also as a component of a broader financial strategy.

Whole Life Insurance vs. Term Life: Which Policy Packs the Biggest Punch?

Whole life insurance and term life insurance serve different needs when it comes to financial planning. Whole life insurance provides coverage for the policyholder's entire lifetime, ensuring that a payout is guaranteed upon death, no matter when it occurs. This type of policy also builds cash value over time, which can be borrowed against or cashed out, adding an investment aspect to the insurance. In contrast, term life insurance focuses solely on providing coverage for a specified period—typically 10, 20, or 30 years—making it a more affordable option for those seeking substantial coverage without the added investment component. If the term expires while the policyholder is still alive, there is no payout, which represents both a risk and a profound consideration when choosing between the two.

When comparing the two, it's essential to analyze personal financial goals and family needs. Whole life insurance can be viewed as a long-term financial tool that combines insurability with wealth accumulation, while term life insurance is often considered a safer bet for young families needing immediate protection without breaking the bank. For example, if you're looking to cover your children's education or provide a financial cushion for your spouse until retirement, term life may offer the extensive coverage at a lower initial cost. However, if you're considering a lifelong legacy or want a policy that contributes to your overall net worth, whole life insurance might provide the biggest punch in terms of benefits over your lifetime.

How Whole Life Insurance Builds Cash Value: A Comprehensive Guide

Whole life insurance is a unique financial product that offers not only death benefits but also a way to build cash value over time. Unlike term life insurance that strictly provides coverage for a set period, whole life policies are designed to last a lifetime, accumulating value that policyholders can access during their lifetime. The cash value grows at a guaranteed rate, and this growth is tax-deferred, meaning you won't owe taxes on the gains until you withdraw them. Typically, a portion of your premium payments goes into this cash value account, allowing it to climb steadily and serve as a potential resource for emergencies or opportunities.

As you pay your premiums, the cash value of your whole life insurance policy can be accessed through loans or withdrawals, giving you financial flexibility. It’s important to note that withdrawing cash value may reduce your death benefit, and outstanding loans accrue interest, which can further impact the overall value of the policy. Therefore, understanding how whole life insurance builds cash value is crucial for anyone considering this form of coverage. By balancing your insurance needs with the potential for cash accumulation, you can create a financial strategy that not only protects your loved ones but also provides a valuable asset for your future.