Ride the Waves: Surfing Adventures and Tips

Explore the world of surfing with expert advice, gear reviews, and the latest trends.

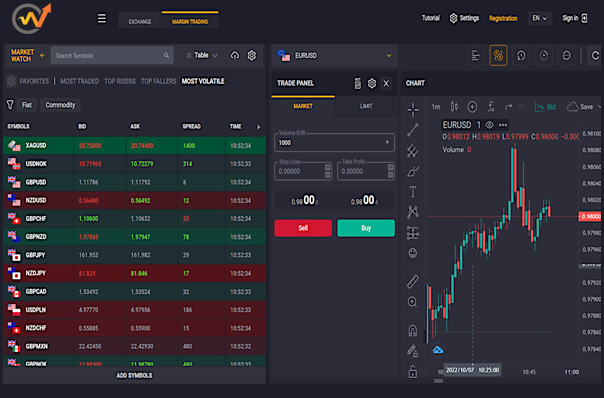

Forex Fables: Tales from the Trading Trenches

Discover riveting stories and lessons from the trading trenches in Forex Fables. Unlock your trading potential with our captivating tales!

The Psychology of Forex Trading: Lessons from the Trenches

The world of Forex trading is not just about numbers and charts; it is deeply intertwined with human behavior and psychology. Traders often face psychological challenges that can significantly impact their decision-making process. Key lessons drawn from experiences in the trenches highlight the importance of emotional intelligence and self-discipline. For instance, the fear of losing can lead to impulsive decisions and overtrading, while greed can cloud judgment. Understanding these emotional responses is crucial for developing a successful trading strategy.

Furthermore, the concept of trader psychology emphasizes the need for a robust mental framework. This includes setting realistic goals, maintaining a trading journal, and practicing mindfulness to manage stress and anxiety. By cultivating a disciplined mindset, traders can resist the temptation to chase after losses or make irrational trades. Ultimately, the lessons learned from the trenches teach us that mastering the psychological aspects of Forex trading is just as important as honing technical skills, making it essential for long-term success in the market.

How to Develop a Winning Trading Strategy: Real-Life Experiences

Developing a winning trading strategy requires a blend of knowledge, experience, and adaptability. Many successful traders emphasize the importance of **backtesting** their strategies in a risk-free environment. For instance, Jane Doe, a retail trader from New York, shared her journey of moving from manual trades to automated strategies. After extensive research and experimenting with backtesting software, she discovered that incorporating technical indicators like the **Moving Average Convergence Divergence (MACD)** improved her decision-making process significantly.

In addition to technical analysis, psychology plays a crucial role in trading success. John Smith, a seasoned investor, learned the hard way that emotional discipline is key. He recalls a time when his **fear of missing out (FOMO)** led him to chase a stock that eventually plummeted, resulting in significant losses. To combat this, he developed a set of **rules** to follow, including a strict stop-loss mechanism and a commitment to only trading based on his research rather than market hype. These real-life experiences underline that creating a winning trading strategy combines both strategic analysis and personal discipline.

What Every New Trader Should Know: Common Pitfalls and Success Stories

Every new trader should be aware of the common pitfalls that can hinder their success in the financial markets. One of the biggest mistakes is overtrading, which occurs when traders execute too many trades in a short period, often leading to increased transaction costs and emotional burnout. Additionally, neglecting risk management can result in substantial losses. New traders often fail to set stop-loss orders or overextend their leverage, putting their capital at risk. To avoid these traps, it's essential to develop a strong trading plan and stick to it, prioritizing discipline over impulsive decisions.

On the flip side, there are numerous success stories that can inspire new traders. Many seasoned traders emphasize the importance of learning from failures, as each setback provides valuable lessons that can enhance trading strategies. For instance, a trader might initially struggle with market volatility but eventually learn to embrace it, turning potential losses into profits. By studying the experiences of successful traders and implementing proven strategies, newbies can build confidence and develop their own pathways to success. Remember, persistence and a willingness to adapt are key attributes for achieving trading success.