Ride the Waves: Surfing Adventures and Tips

Explore the world of surfing with expert advice, gear reviews, and the latest trends.

The Currency Circus: High Stakes and How Not to Fall Off

Step right up to The Currency Circus! Discover high-stakes trading tips and tricks to keep you from falling off the tightrope of finance!

The High Stakes of Currency Trading: Strategies to Stay in the Game

Currency trading, often viewed as a fast-paced and high-reward arena, carries significant risks that can lead to substantial losses if not approached with caution. **Understanding market fundamentals** and keeping abreast of global economic indicators is crucial for traders looking to navigate this volatile landscape. Many traders rely on a combination of **technical analysis** and **fundamental analysis** to inform their decisions. This might include monitoring interest rates, employment data, and geopolitical events that can cause fluctuations in currency values. Adopting **risk management strategies** such as setting stop-loss orders and diversifying investments can also help mitigate potential losses.

To thrive in currency trading, developing a robust trading strategy is essential. Here are some strategies to consider:

- Trend Following: Identify and align your trades with existing market trends.

- Scalping: Engage in short-term trades to capitalize on small price movements.

- Carry Trade: Borrow in a currency with a low interest rate and invest in one with a higher return.

Incorporating **discipline** and maintaining emotional control are paramount in ensuring long-term success. By continuously learning and adapting strategies based on market conditions, traders can position themselves to stay in the game, despite the high stakes involved.

Common Pitfalls in Currency Exchange: How to Avoid Falling Off the Tightrope

When engaging in currency exchange, many individuals and businesses often overlook the importance of understanding the fluctuating nature of exchange rates. One common pitfall is waiting too long to convert currency, which can lead to significant financial losses if rates move unfavorably. To avoid this, keep a close watch on market trends and set an alert for favorable rates. Additionally, comparing exchange rates across various platforms is crucial, as rates can vary widely. Utilizing online tools can help you make informed decisions and minimize risks.

Another frequent mistake is neglecting hidden fees that can substantially impact the total amount received after exchange. Many service providers, whether banks or currency exchange offices, may charge additional fees that aren't immediately obvious. To navigate this pitfall, it's essential to read the fine print and inquire about all potential charges upfront. Consider using services that offer transparent fee structures, and always calculate the true cost of the exchange before committing to a transaction. This diligence will safeguard your finances and enhance the overall currency exchange experience.

Is Forex Trading Right for You? Assessing the Risks and Rewards

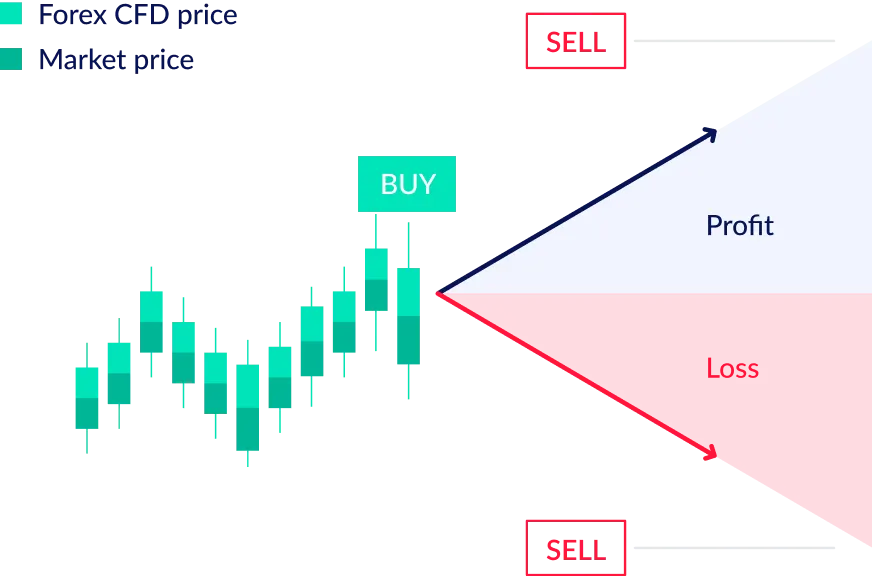

Forex trading, or foreign exchange trading, involves the buying and selling of currencies with the aim of making a profit. Before diving in, it's crucial to assess whether this market aligns with your financial goals and risk tolerance. Forex trading can be highly lucrative, but it also carries significant risks. Factors such as market volatility, leverage usage, and psychological pressure can impact your trading outcomes. Therefore, it's essential to understand your own risk appetite and trading strategy. Are you someone who can handle the stress of rapid fluctuations, or do you prefer a more stable investment approach?

The potential rewards in Forex trading can be enticing, yet they come hand-in-hand with the possibility of substantial financial loss. As you consider if Forex trading is the right path for you, it might be helpful to evaluate your personal circumstances. Do you have a solid understanding of market fundamentals? Are you willing to invest time in education and research? Strategies such as risk management and disciplined trading can mitigate the downsides, but they require commitment and practice. Ultimately, weighing the risks against the rewards will help you make an informed decision about your entry into the Forex market.