Ride the Waves: Surfing Adventures and Tips

Explore the world of surfing with expert advice, gear reviews, and the latest trends.

Cheap Insurance Hacks You Didn't Know You Needed

Unlock hidden savings with these cheap insurance hacks! Discover tips you never knew you needed and start saving today!

5 Little-Known Tips to Slash Your Insurance Premiums

If you're looking to save money on your insurance premiums, you're not alone. Many consumers are unaware of the various strategies that can help slash your insurance premiums. Here are some lesser-known tips to consider:

- Review your coverage annually: As your life changes, so do your insurance needs. Make sure to evaluate your policies at least once a year to remove any unnecessary coverage that can inflate your premiums.

- Bundle your policies: Many insurance companies offer significant discounts when you bundle multiple policies, such as auto and home insurance. This can lead to substantial savings while simplifying your billing process.

In addition to the above tips, consider these unique strategies to further reduce your costs:

- Increase your deductible: Opting for a higher deductible can significantly reduce your premium. Just ensure that you have enough savings to cover the deductible amount in case of a claim.

- Take advantage of discounts: Many insurers offer discounts for various reasons, such as maintaining a good driving record, being a member of certain organizations, or installing security systems in your home.

- Stay loyal: Some insurers provide loyalty discounts for long-term customers, so maintaining your policy with the same company can prove beneficial in the long run.

The Ultimate Guide to Maximizing Discounts on Your Insurance

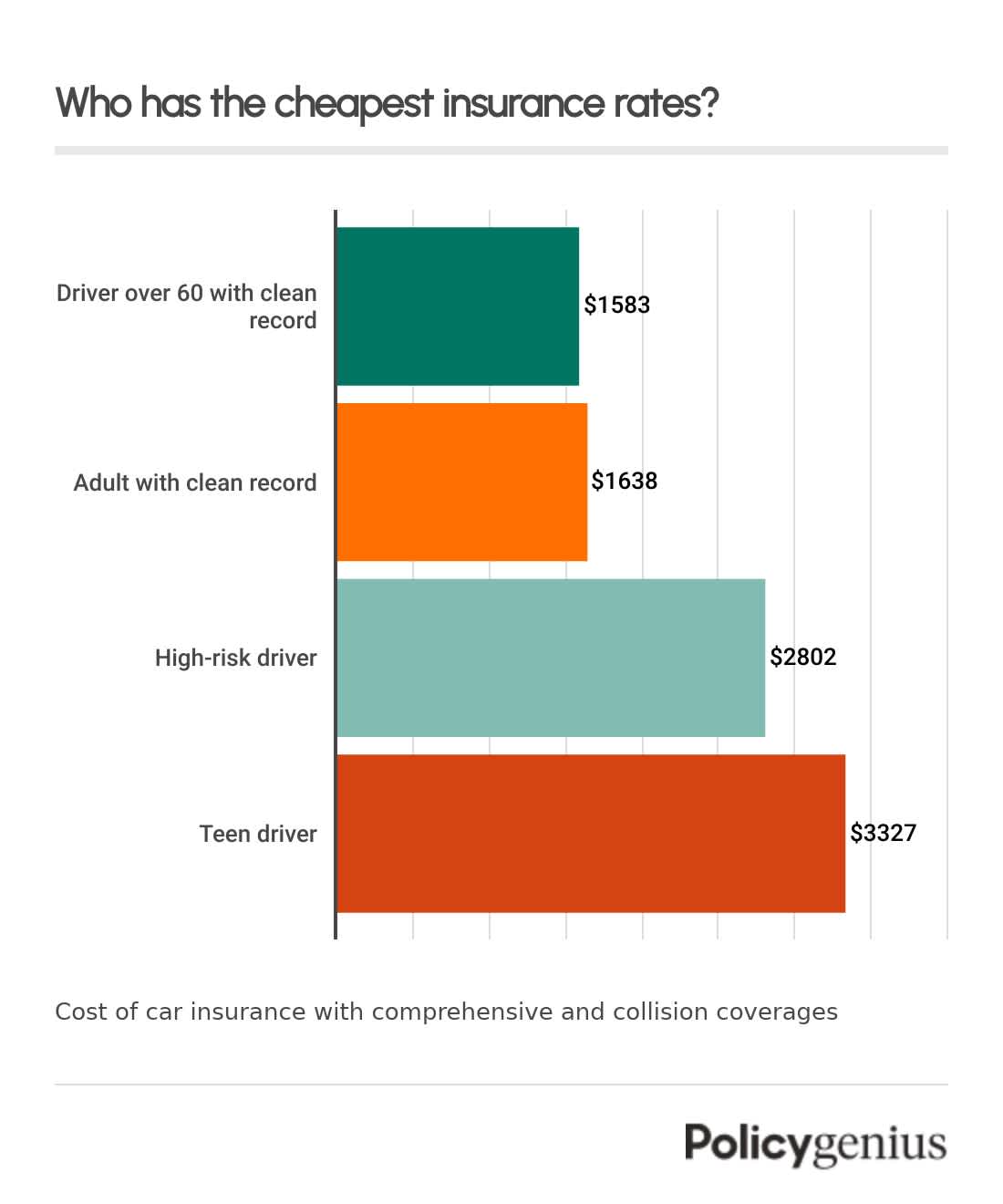

When it comes to maximizing discounts on your insurance, understanding the various types of discounts available is crucial. Insurers often provide discounts based on multiple criteria, including your driving history, the safety features of your vehicle, and your affiliation with certain organizations. Here’s a brief overview of some common discounts you should look for:

- Safe Driver Discounts: If you maintain a clean driving record, many insurance companies will reward you with lower premiums.

- Multi-Policy Discounts: Bundling multiple policies, such as home and auto insurance, can lead to significant savings.

- Good Student Discounts: Young drivers who perform well academically may qualify for lower rates.

Additionally, taking advantage of seasonal promotions and periodically shopping around can further enhance your savings. Insurance providers frequently run special offers, so it's wise to review your policy regularly and inquire about any available discounts during your renewal process. Consider these tips to help you secure the best deals:

- Comparison Shop: Don’t settle for the first offer—compare rates from multiple insurers.

- Review Your Coverage: Sometimes, adjusting your coverage levels can lead to easier and more substantial discounts.

- Ask About Discounts: Always ask your agent if there are any available discounts that might apply to your circumstances.

Are You Overpaying? Common Insurance Myths Debunked

When it comes to insurance, misconceptions abound, often leading individuals to overpay for their coverage. One common myth is that a higher premium guarantees better protection. In reality, the quality of insurance depends on various factors, including the policy details, the provider's reputation, and the specific needs of the insured. It's crucial to understand that not all insurance plans with high premiums offer comprehensive coverage, which is why it's essential to compare policies, read the fine print, and consult experts when necessary.

Another prevalent myth is that maintaining multiple policies with the same insurer will always result in lower rates. While bundling can indeed offer discounts, it isn’t a universal rule. Some policies may not have the same terms or coverage limits, potentially leading to higher costs if a significant claim is made. To ensure you are not overpaying, it's wise to review your coverage annually, assess your needs, and consider shopping around for different quotes. This practice can pinpoint more affordable options while ensuring that your policy meets all necessary requirements.