Ride the Waves: Surfing Adventures and Tips

Explore the world of surfing with expert advice, gear reviews, and the latest trends.

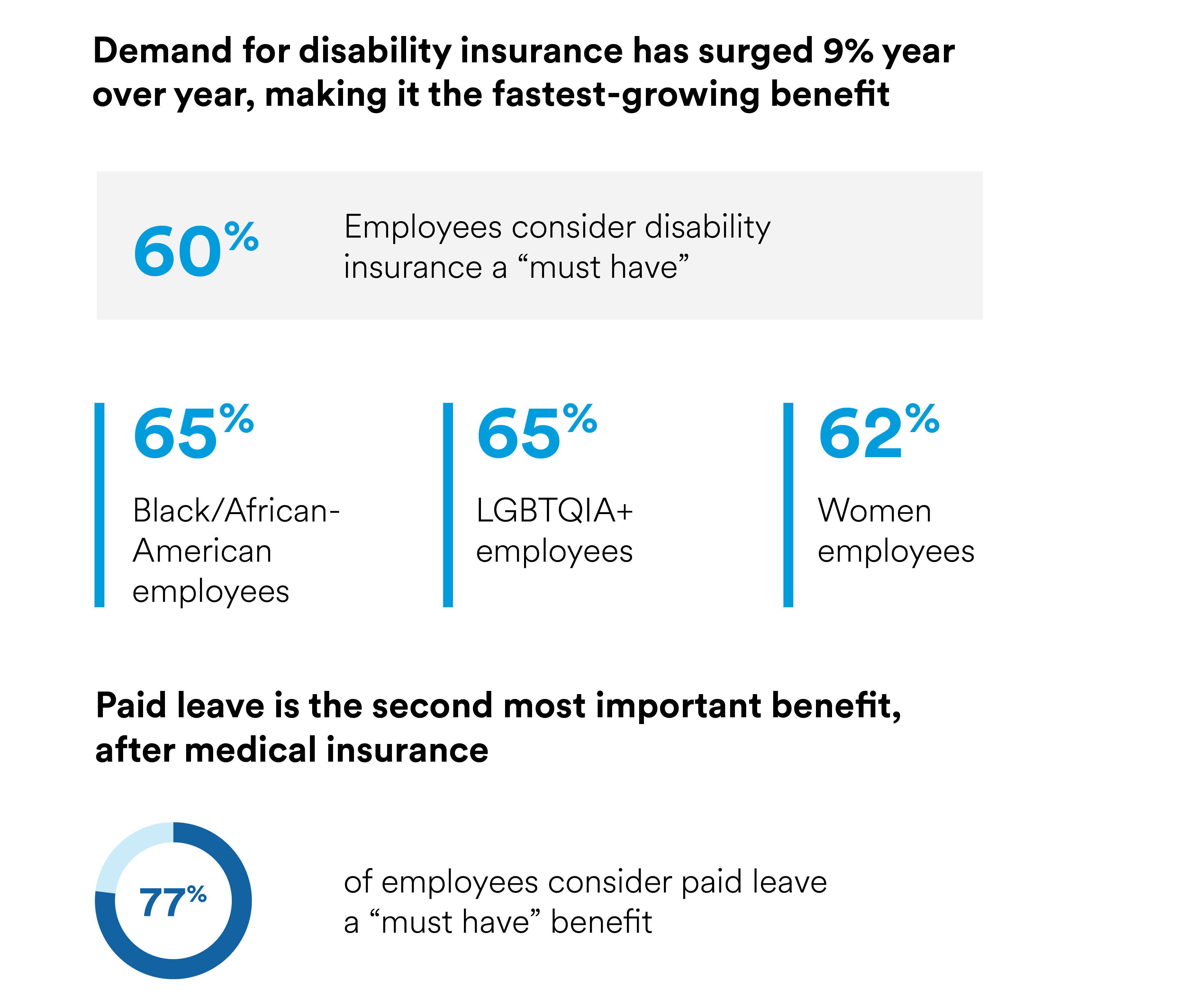

Disability Insurance: Your Safety Net in Disguise

Discover how disability insurance can be your hidden safety net, protecting your income and peace of mind when you need it most!

Understanding Disability Insurance: Why It's Essential for Your Financial Security

Understanding disability insurance is crucial for anyone looking to secure their financial future. This type of insurance provides income replacement if you are unable to work due to a disability caused by an injury or illness. According to the Social Security Administration, about 1 in 4 young workers will become disabled before reaching retirement age. Without financial support in these challenging times, individuals may struggle to pay daily living expenses, medical bills, and more, making disability insurance an essential part of your overall financial strategy.

Investing in disability insurance not only protects your income but also offers peace of mind. Many people underestimate the probability of becoming disabled, leading them to overlook this vital coverage. In fact, the National Center for Biotechnology Information suggests that understanding the terms and conditions associated with disability insurance is key to making informed decisions. By having this safety net in place, you can focus on your recovery without the added stress of financial strain, ensuring that you and your loved ones have the support you need during difficult times.

Common Misconceptions About Disability Insurance: What You Need to Know

Many people hold misconceptions about disability insurance that can lead to confusion and inadequate protection. One common myth is that disability insurance is only for those in physically demanding jobs. In reality, anyone can become disabled, regardless of their profession. According to the Council for Disability Awareness, a significant portion of disability claims comes from mental health issues, injuries, and illnesses. Thus, it’s crucial for all employees, from desk jobs to labor-intensive roles, to consider obtaining adequate coverage.

Another misconception is that disability insurance is an entitlement provided by employers or the government. While some employers offer short-term and long-term disability options, not all plans provide comprehensive coverage, and government programs may have strict eligibility requirements. Individuals often overlook the importance of purchasing their own personal disability insurance to ensure they have the financial support they need. Understanding the specifics of different policies can empower individuals to make informed decisions about their coverage needs.

How to Choose the Right Disability Insurance Policy for Your Needs

Choosing the right disability insurance policy is crucial to ensuring financial security in the event of an unexpected illness or injury. Start by assessing your personal needs, which can vary based on factors such as your income, expenses, and overall health. It's essential to understand the different types of disability insurance available, including short-term and long-term policies. According to Investopedia, long-term disability insurance is generally recommended for most individuals as it provides coverage for more extended periods, often until retirement age. Evaluate the coverage amount you need, considering your monthly expenses and the duration for which you might be unable to work.

Once you have a clear understanding of your needs, it is time to compare various insurance providers and their policies. Look for policies that offer flexible terms and conditions, such as non-cancellable coverage and own occupation definitions. A policy with an 'own occupation' definition allows you to receive benefits if you can no longer perform the specific duties of your job, even if you can work in another capacity. For more insights, check NerdWallet. Lastly, consider consulting with a financial advisor or insurance broker who can help guide you through the selection process and ensure you choose a policy that adequately protects your financial future.