Ride the Waves: Surfing Adventures and Tips

Explore the world of surfing with expert advice, gear reviews, and the latest trends.

Whole Life Insurance: Because Life is Full of Surprises

Discover how whole life insurance protects your family from life's surprises. Secure your future today!

What is Whole Life Insurance and How Does it Work?

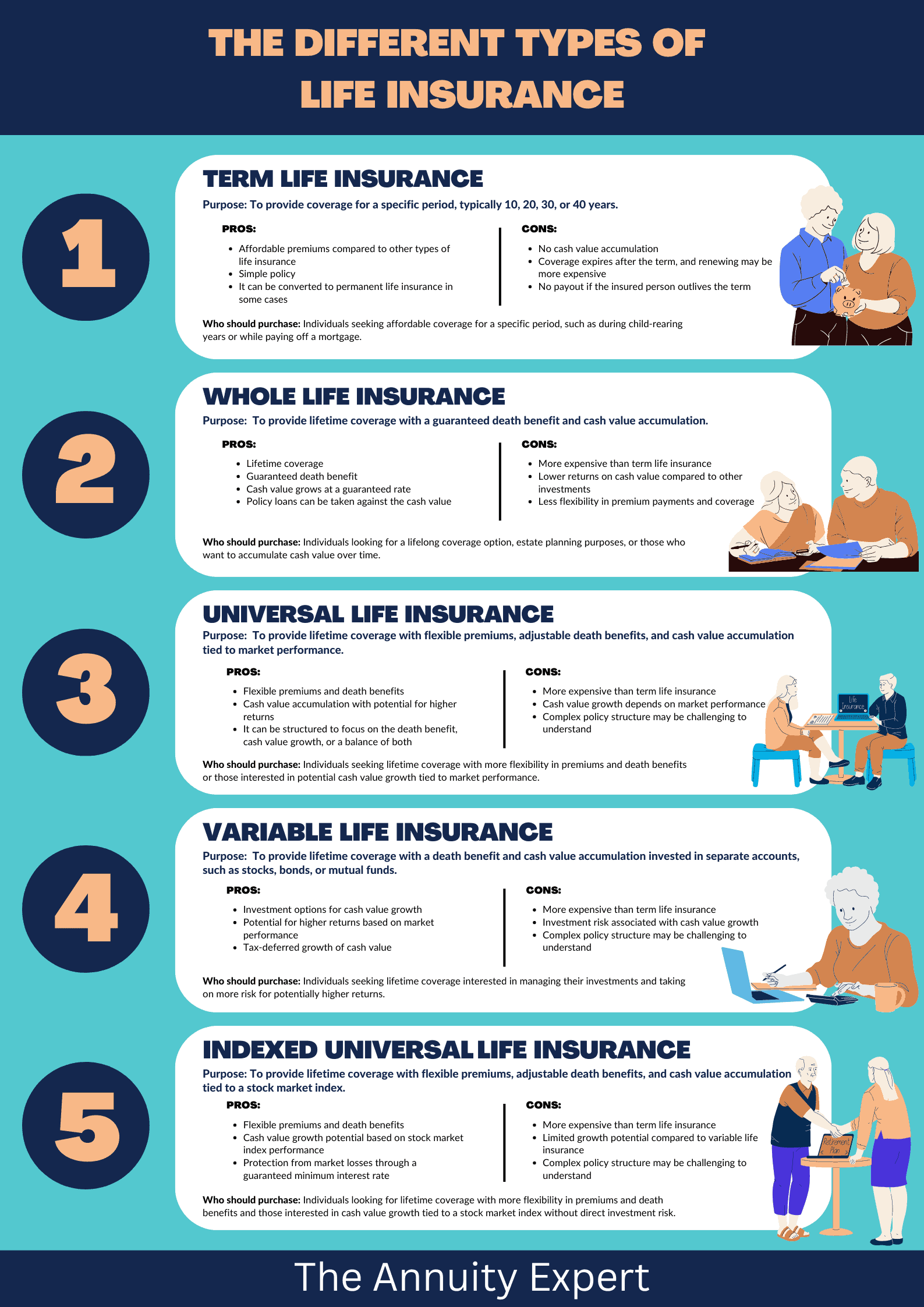

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured, as long as premiums are paid. Unlike term life insurance, which offers protection for a specified period, whole life insurance accumulates a cash value over time. This cash value grows at a guaranteed rate and can be borrowed against, withdrawn, or used to pay premiums. Additionally, whole life insurance typically has higher premiums compared to term policies, but it offers the benefit of lifelong coverage and a savings component that can serve as a financial resource in the future.

Understanding how whole life insurance works is essential for making informed financial decisions. When you purchase a whole life policy, part of your premium goes towards the death benefit, while the remainder funds the cash value accumulation. Over the years, as the cash value builds, it earns dividends, which can be reinvested or taken as cash. It's important to note that if you choose to take out a loan against the cash value, the outstanding balance will reduce the death benefit. Thus, while whole life insurance can be a valuable long-term investment, careful consideration of your financial goals and needs is crucial.

Top 5 Reasons to Choose Whole Life Insurance for Your Financial Security

When considering your long-term financial security, whole life insurance stands out as a robust option. Unlike term life insurance, which provides coverage for a predetermined period, whole life insurance offers lifetime protection, ensuring that your loved ones are financially safeguarded no matter when you pass away. This type of policy also builds cash value over time, allowing you to borrow against it or withdraw funds when needed. This dual benefit of protection and investment makes whole life insurance an appealing choice for individuals seeking both security and growth in their financial portfolio.

Another compelling reason to choose whole life insurance is the guaranteed death benefit it provides. This ensures that your beneficiaries will receive a predetermined sum upon your passing, providing them with necessary financial support during a challenging time. Additionally, the premiums for whole life insurance are fixed and do not increase as you age, making it easier to budget your expenses. Below are key reasons to consider:

- Lifetime coverage ensures peace of mind.

- Cash value accumulation offers a savings component.

- Fixed premiums protect against inflation.

- Guaranteed death benefits provide financial security for beneficiaries.

- Flexible policy options allow for tailored financial planning.

How Whole Life Insurance Can Protect Your Family from Unexpected Events

Whole life insurance is a vital financial tool that offers more than just a death benefit. It provides long-term security and peace of mind for your family in the face of unexpected events, such as an untimely death or a sudden financial crisis. Unlike term insurance, which only covers you for a specified period, whole life insurance lasts a lifetime, guaranteeing that your loved ones are protected no matter when the unexpected occurs. This type of policy also builds cash value over time, which can be accessed in emergencies, making it a flexible option for families looking to secure their future.

In addition to the death benefit, whole life insurance can serve as a financial safety net for your family. In the event of a serious accident or illness, the cash value accumulated within the policy can be borrowed against to cover medical expenses, education costs, or even mortgage payments. As a result, whole life insurance empowers families to navigate financial challenges better, allowing them to maintain their standard of living without the added stress of financial instability. Ultimately, investing in whole life insurance is a proactive step toward ensuring your family’s security amidst life's uncertainties.