Ride the Waves: Surfing Adventures and Tips

Explore the world of surfing with expert advice, gear reviews, and the latest trends.

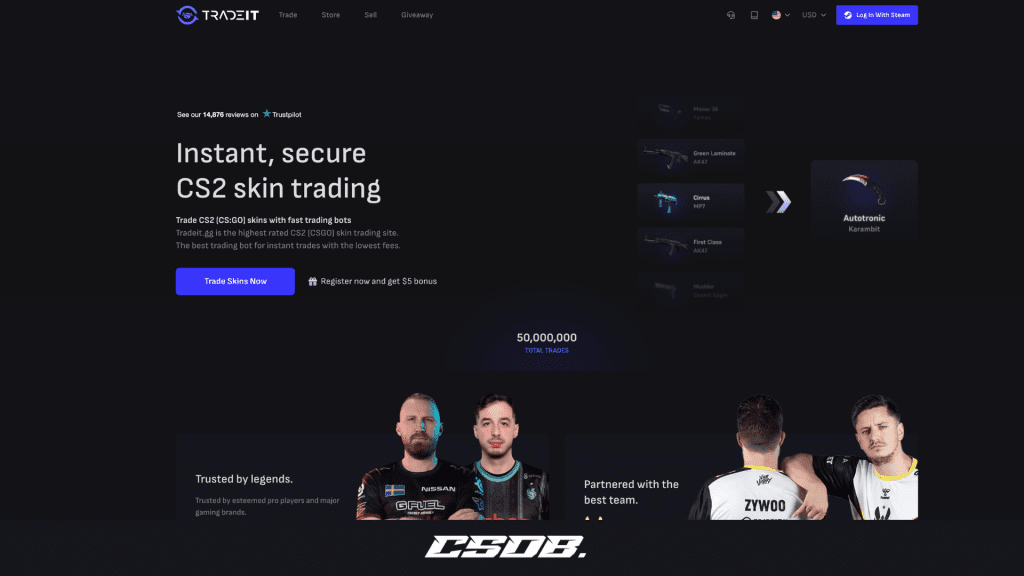

Trade Bots Gone Wild: Why CSGO's Digital Dealers Are Changing the Game

Discover how trade bots are revolutionizing the CSGO landscape. Dive into the chaos and see why these digital dealers are game-changers!

Understanding Trade Bots: The Mechanics Behind CSGO's Digital Economy

The rise of trade bots in the digital economy of Counter-Strike: Global Offensive (CS:GO) has transformed how players interact with in-game assets. These automated systems enable instant exchanges of items, eliminating the cumbersome manual trading process. Players can access a vast marketplace where they can exchange skins, stickers, and other in-game items with ease. By leveraging APIs, trade bots can quickly assess market values and ensure fair trades, contributing to a more fluid economic environment. As a result, understanding the mechanics of these bots becomes crucial for anyone looking to navigate the intricate world of CS:GO trading.

At the core of trade bots is a set of algorithms designed to analyze market trends and establish optimal trading conditions. These bots operate by monitoring item prices across various platforms and adjusting their offering prices in real-time. Additionally, the use of Steam's API allows trade bots to instantly process trades, ensuring a seamless experience for users. However, with the convenience comes the risk of scams and malicious bots. Therefore, both new and experienced traders must be vigilant and learn how to identify reliable trade bots to protect their assets. As the digital economy continues to evolve, so too will the role of these automated systems in shaping the future of CS:GO trading.

Counter-Strike is a highly popular tactical first-person shooter that has been a staple in the gaming community for years. With the recent release of Counter-Strike 2, players are exploring new gameplay mechanics and strategies. One exciting aspect of the game is the cs2 retake servers, which offer a unique twist on standard matches, allowing players to focus on clutch situations and teamwork.

Are Trade Bots the Future of CSGO Trading? Insights and Predictions

The rise of technology has significantly transformed various aspects of online gaming, including trading in popular titles like CS:GO. Trade bots have emerged as a revolutionary tool that facilitates quicker and more efficient trades among players. These automated systems utilize algorithms to analyze market trends, monitor item values, and execute trades based on user-defined parameters. By reducing the time spent on manual trading and minimizing human errors, trade bots are enhancing players' trading experiences. As the demand for in-game items continues to grow, many speculate that trade bots may very well be the future of CSGO trading.

Looking ahead, we can expect several trends that will shape the future of CSGO trading. First, as more players adopt trade bots, we may witness a surge in competition, prompting developers to improve these bots' functionalities to stay relevant. Moreover, the integration of advanced algorithms, such as machine learning, will likely allow trade bots to predict market fluctuations more accurately. Finally, security concerns surrounding automated trading will urge developers to create robust protections against fraud, further legitimizing the use of trade bots in the CS:GO trading ecosystem. Overall, the intersection of technology and gaming is set to redefine how players engage with in-game economies.

The Dark Side of Trade Bots: Risks and How to Navigate Them

The emergence of trade bots has revolutionized the trading landscape, providing users with automated strategies and the promise of higher profits. However, the dark side of trade bots is often overshadowed by their allure. One of the primary risks associated with these automated systems is the potential for significant financial loss due to poor algorithm performance, market volatility, or unforeseen events. In addition, the reliance on trade bots can lead to a complacency in traders, who may lose touch with market analysis and changing dynamics. Understanding these risks is crucial for anyone considering the use of a trade bot.

To effectively navigate the risks associated with trade bots, it is essential to adopt a proactive approach. Here are some strategies to mitigate potential pitfalls:

- Do thorough research: Investigate the reputation and performance of trade bots before committing any funds.

- Set clear parameters: Establish realistic risk management settings within your trading strategy.

- Monitor performance: Regularly review and adjust bot settings based on market conditions.

- Stay educated: Continuously learn about trading principles and market trends to maintain an informed perspective.

By being aware of the pitfalls and actively implementing safeguards, traders can harness the benefits of trade bots while minimizing their inherent risks.